The price of plastic resin has increased by more than 50 %, hitting all time historical highs never experienced before. What’s more, the plastic material stock is not available sometimes at all, risking considerable disruptions in the supply chain. This is now affecting the price and availability of all plastic products and packaging materials. How did the industry got into this pickle?

There’s not one right answer. Rather it is a consequence of poor planning, varying expectations, natural disasters, and of course the Covid pandemic followed by some truly weird decisions in the last 10 months. All of these happened in such an untimely consequence, step by step and its combination resulted in huge leverage on price and scarcity. I will try to show my subjective opinion on the matter.

Limited Supply

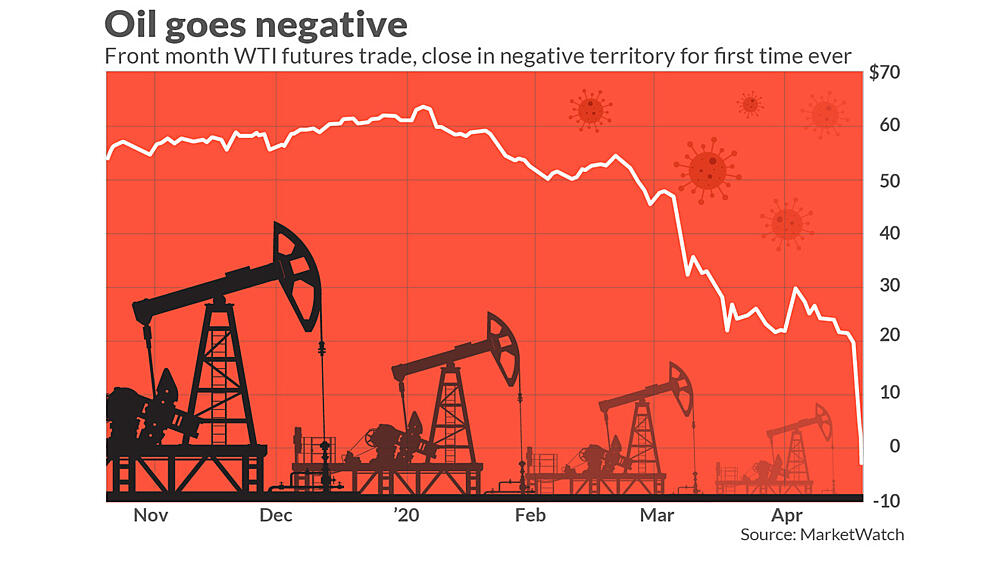

As you may suspect it all started with the Pandemic. Some factories such as automotive were shutting down and therefore suppliers of plastic resin expected a significant decrease in demand. In April 2020 the crude oil was trading below zero at negative prices. It made no sense to extract any oil if it trades at low prices. The problem is, however, that crude oil is important also because of its byproducts such as monomers which are crucial for the production of plastic (polyethylene, polypropylene, etc.) Monomers were therefore unavailable and thus many plastic suppliers stopped production and decided to shut down.

Covid-19 has also affected the transport costs of shipping containers. Some ports in the US, Australia, and others were unloading very slowly, and a lot of containers were stuck at ports waiting for unloading. The lack of empty containers has pushed the prices way up, so it made no sense to import plastic resin from Asia.

High Demand

What has happened next? Surprisingly, the demand increased again because of quick economic recovery pulled by the automotive industry, and increased demand for eCommerce and packaging (to go food and online shopping were the only options for people who stayed at home). Things could change, as more industry orders based on price-sensitive elastic demand falls away, but there is plenty of new inelastic demand that was not even a consideration in the past. I am talking about billions of face masks and syringes that are paid for by governments and insurance companies. They would pay any price regardless of the cost of plastic material.

Production Cuts

All of this caused major supply/demand disbalance which was further deepened by series of natural disasters in the USA. Autumn hurricanes and the winter polar vortex in January cut the production of plastic materials by 80 % in the US. The US normally exports 40% of plastic resin but instead started to import and grabbed most of the supplies from Europe. European stock dried out and the prices jumped.

Source: nbcnews.com

And as it wouldn’t be enough, some factories closed for maintenance which was planned long ahead as they expected low demand. Could they cancel the downtime knowing the situation on the market? They claim NO, but maybe they just don´t mind their prices being sent to the record levels. Somehow like in 2015.

Production of plastic resin is not a matter of just pushing the button. The gigantic factories need weeks or months to even start-up. Therefore the situation may last well until Q3 or Q4 with no guarantee the plastic resing prices will ever trade at their usual price levels.

At Plastkon we produce flower pots and sleds mainly from PP and PE. Fortunately, the gardening, DIY, and outdoor industry growth is magnificent. The demand from consumers is growing at a record pace. Everyone seeks flower pots, watering cans, and the sales of sleds last winter were a record. I have great confidence in the consumers and our distributors and I am sure that they will appreciate those products they grew so fond of even with a higher price tag.